Solidarity post-Covid: paying fair price for accommodation

The post-lockdown period is starting to show up the tensions between supply and demand in traditional tourist markets. This short article explores how important it is for smaller countries such as Portugal to resist deflationary pressures and the tendency to deep discount. How can a nation so in need of income get its tourists to show solidarity by paying fair price for accommodation?

Coronavirus, as everyone knows, has changed the world. Unprecedented times. And never-before-seen economic impact.

I was prompted to write this short article by a report I spotted yesterday, but that was published last year by Caixabank research. The data was collated by Forwardkeys, a Spanish company that tracks tourist numbers, in particular airline passengers.

Although the report was written pre-Coronavirus, it highlighted Portugal as the world’s 17th most visited country (out of 180). SEVENTEENTH. Top 10%. A country punching above its weight in terms of its appeal. A country that clearly is not in the “cheap and cheerful” club, but one where, by virtue of its global standing

In 2018, tourism represented around 15% of GDP. According to OECD.stat quotes tourism revenue in 2018 as €20.5 billion. Europe represented 80% of foreign or international tourism. Non-European tourism, however, is growing faster than that from within Europe.

Spain, Portugal’s only neighbour and the world’s 2nd largest tourist market by arrivals, generated €69 billion in tourism revenue in the same period.

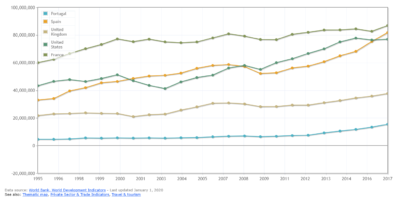

The World Bank and WTO cite that in 2018, Portugal received 16 million foreign visitors while Spain received 82 million (France 89 million, UK 36 million, US 79 million), although Spain also had a significant number (41 million) same-day international visitors or excursionists (of which only 2.8 million were cruise passengers).

The World Bank also cite that in 2018, tourism generated $24 billion in revenues for Portugal and $81 billion in Spain (France $72 billion, UK $49 billion, US $256 billion).

This means that revenue per tourist, using 2018 numbers, is $1,500 in Portugal and $988 in Spain (France $809, UK $1,361, US $3,241). This means that Portugal has managed to achieve a high revenue per tourist, reflecting the quality of the destination.

In addition, a metric that can also be used is how much revenue is generated by inhabitant, and using this metric Portugal generates $2,354 per capita and Spain $1,732 (France $1,103, UK $722, US $773). The top country using this metric is Aruba with $15,220 per inhabitant. This metric reflects a situation of smaller countries that have to “sweat their assets” to generate a higher revenue per capita. Any deflationary effects can have adverse long-term effects on the market and detract from the reputation of quality of the particular market.

The number of revenue-generating assets (ranging from number of accommodation units, natural attractions, airports, miles of coastline, etc.) in smaller countries is limited and cannot be easily expanded. It is therefore incumbent on all players in the travel and tourism sector to fight any dramatic or excessive deflationary change that might have a long-term effect on the lowering of Key Performance Indicators (KPIs) such as revenue per tourist and revenue per inhabitant.

With the advent of Coronavirus, many tourist businesses spent all of March and April processing refunds for cancelled visits, primarily accommodation. In May these same businesses are spending most of their time answering inquiries that start something like this: “because of the pandemic, prices will fall dramatically and so we are looking for accommodation where owners will be happy to receive some guaranteed income” or like this: “because summer tourism is unlikely, owners should be prepared to accept long lets starting in the summer at winter prices. Better a bird in the hand…” or Facebook posts along these lines: “We are a tidy, responsible couple with good references, and a very clean dog, looking for a sea front rental, utilities included. We are not looking for holiday prices”

The Covid-19 pandemic has already seen a natural reduction in prices. Much of this has been caused by short-term rental owners, panicked by lack of demand in the traditional summer months, either reducing prices or transitioning their properties to longer-term lets (knowing full well they will abandon the sector when the short-term market improves again).

Over the years, the tourism market has seen a large increase in tourists willing to negotiate. Even traditionally conservative nations, such as the English, have become supreme bargain-hunters. Under the current crisis, this bargaining has reached unprecedented levels.

As I have written before, owners and property managers need to very carefully balance the need for bookings to kick-start the post-Coronavirus season, with the need to generate a sensible profit. The supply side needs to consider its costs, including a substantial tax burden of 28% on turnover, and ensure that this burden, together with other costs such as cleaning, utilities (when included), property tax, maintenance and any condominium charges, are made clear, if required, to the client. Any onerous conditions such as Covid-19 refunds need to be linked to government policy on travel, and blanket cancellations must be avoided in order not to cause a knock-on effect of continually delayed bookings. The tourism ecosystem must realise that capacity is finite and irrecoverable. A booking delayed from one summer to the next will create a gap in the calendar with no revenue. Some owners have now begun to implement their original cancellation policies, preferring to at least retain a deposit and generate at least some revenue.

As recently as May 17, a Facebook post by an ex-resident of California called out the person marketing a 2-bedroom quality townhouse in a very good condominium with pool, restaurant and tennis courts, for €1,000 per month, as being as expensive as California prices. Of course, that person was immediately subjected to a range of ironic comments such as where in California he was from, and that he was confusing a townhouse with a shack. But the more serious conclusion is that this person was one of many who are systematically undervaluing Portuguese real estate inventory. Social media allows unqualified opinion to be easily disseminated. There are people still looking for a solution, months or even years after the start of their search, because their expectations have been set at an unrealistic level. And the hunt for that elusive unicorn continues…

While Portugal needs a return to normality as quickly as possible, owners and managers need to be very careful about not resorting to a “bargain basement” mentality that has pervaded the Portuguese economy for so long. In fact, such is the reputation of the country for undervaluing itself and its own product, that many tourists and potential tenants have adopted the policy of pitching low values with a view to obtaining real estate accommodation at values that are simply not compatible with their quality. As a market, the country cannot afford a return to empty homes where owners feel that prices simply do not merit the risks of damage and wear and tear. This will reduce choice for the consumer or tourist, as well as reduced income for owners and he possible degrading of unoccupied real estate.

Those looking for accommodation will find more competitive prices in the current market. One hopes that those who find the country so appealing recognise that behind real estate accommodation are real people who have been hard hit by the crisis. A few €100 saving in rent could have a big impact on a local family. One hopes that a sense of solidarity will prevail.